Calculate Value at Risk in R

A pension is more valuable than you realize in a low interest rate environment. Area under the ROC.

Varioety Of Demo Notebooks Done With R Python And F Jamesigoe Azurenotebooks Master Github Financial

Suppose that for the original option the.

. For example an R-squared for a fixed. Calculate the inverse of the normal cumulative distribution PPF with a specified confidence interval standard deviation and mean. No cash value and void if transferred or where prohibited.

To arrive at the value for the entire business add up the value of step 4 and the discounted value of step 5 along with any cash cash equivalents if available. The process of identifying outliersFor example if the mean for a certain feature is 100 with a standard deviation of 10 then anomaly detection should flag a value of 200 as suspicious. You may also look at the following articles to learn more The formula for Levered Beta.

When you are done the system will automatically calculate for you the amount you are expected to pay for your order depending on the details you give such as subject area number of pages urgency and academic level. Value at Risk is an industry-wide commonly-used risk assessment technique. 10-year risk for ASCVD is categorized as.

The formula for determining the present value of an annuity is PV dollar amount of an individual annuity payment multiplied by P PMT 1 1 1rn r where. How to Calculate Intrinsic Value. This is a guide to Risk Free Rate Formula.

With a pension you wont be forced to lower your safe withdrawal rate in retirement like those of use who dont have pensions. The Enterprise Value or EV for short is a measure of a companys total value often used as a more comprehensive alternative to equity market capitalization. Many different definitions have been proposed.

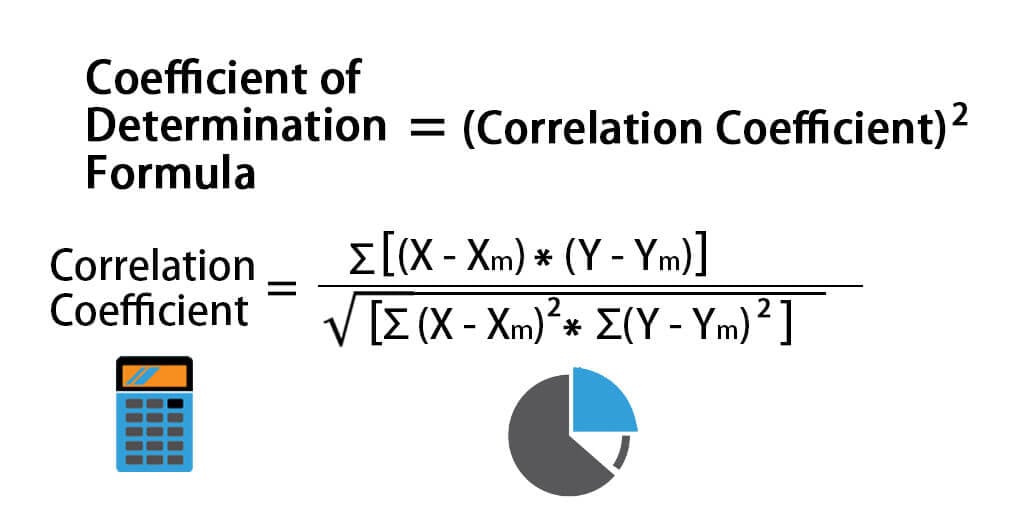

See hierarchical clustering. While R2 suggests that 86 of changes in height attributes to changes in weight and 14 are unexplained. Offer valid for returns filed 512020 - 5312020.

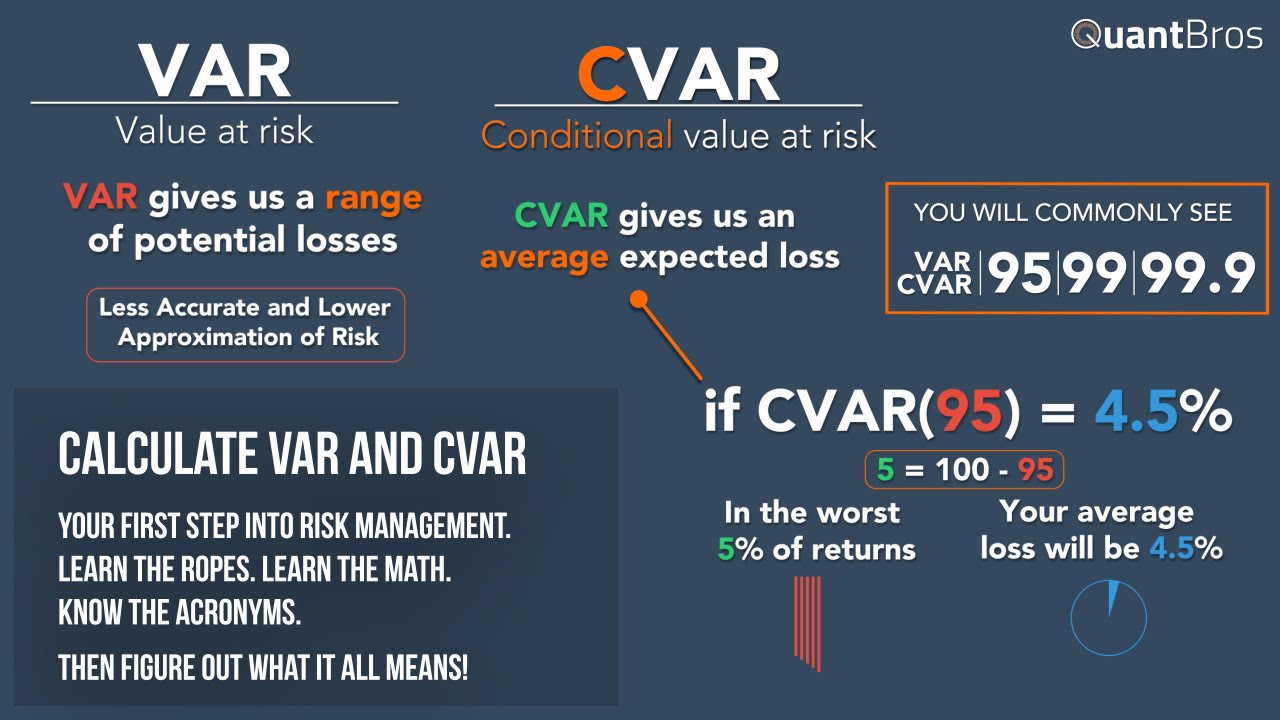

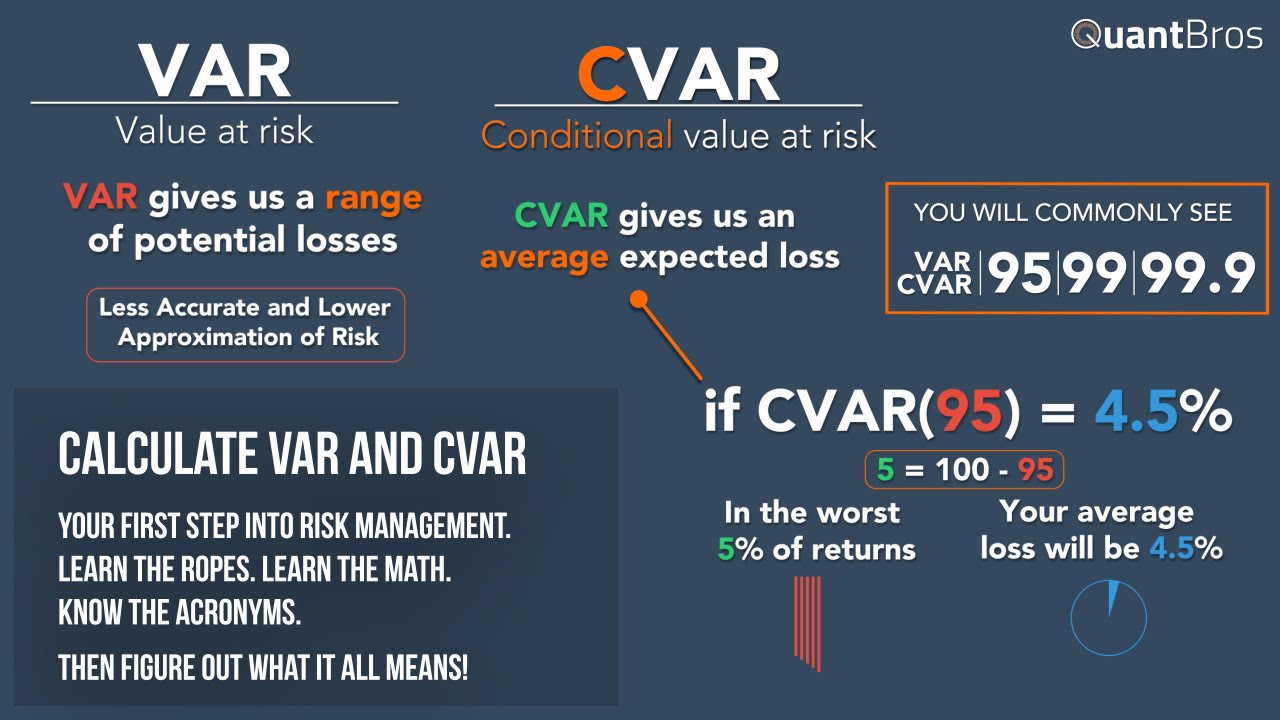

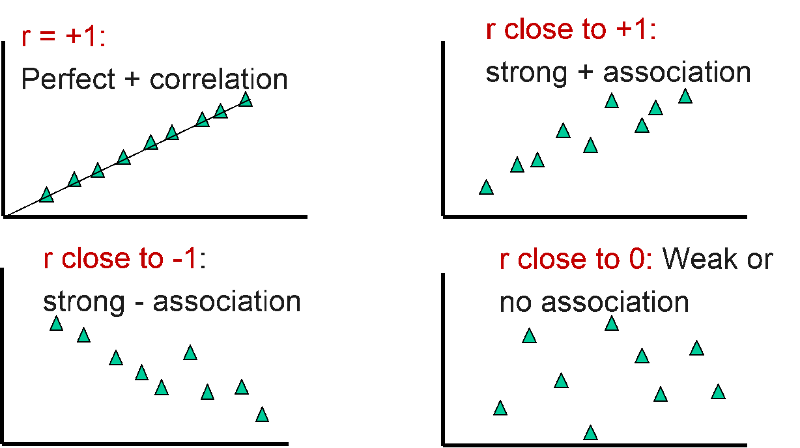

If the two positions were perfectly correlated with r1 the VARs would simply have been additive. Low-risk. As the height increases the weight of the person also appears to be increased.

The odds ratio for the value of the intercept is the odds of a success in your data this is the odds of taking the product when x 0 ie. Area under the PR curve. Must provide a copy of a current police firefighter EMT or healthcare worker ID to qualify.

PMT Dollar amount of each payment. Expected return on an asset r a the value to be calculated. R Discount or interest rate.

VAR is determined by three variables. A specific time period. Terminal value FCFE n Factor.

α r to construct a joint probability distribution for 1 RThey then exploit the functional relationship θ between 1 P and 1 R to convert that joint distribution into a distribution for 1 PFrom that distribution for 1 P value-at-risk is calculated as illustrated in Exhibit 1 above. In the financial world risk management is the process of identification analysis and acceptance or mitigation of uncertainty in investment decisions. The W-4 has a method for you to calculate that.

Read more is as follows. N Number of periods in which payments will be made. This analysis assesses the present fair value of assets projects or companies by taking into account many factors such as inflation risk and cost of capital as well as analyzing the companys future performance.

P Present value of your annuity stream. Finally the intrinsic value per share can be derived by dividing the value in step 6 by the number of shares outstanding of the company. Risk involves uncertainty about the effectsimplications of an activity with respect to something that humans value such as health well-being wealth property or the environment often focusing on negative undesirable consequences.

That means the 7 day value at risk would have been 13295 from 96023693 and not 12469. To simulate this particular environment we assume that we have a series of similar option contracts that commence and expire on a one-day roll-forward basis. The confidence interval of a VaR computation is the chance a specific outcome will occur.

The capitalization rate often referred to as the cap rate is a fundamental concept used in the world of commercial real estate. The correlation is positive and it appears there is some relationship between height and weight. Treasury billNo instrument is completely without some risk including the T-bill which is subject to inflation risk.

The 1 day VAR would be 5025 and not 4712. The higher the confidence. Risk-free rate r f the interest rate available from a risk-free security such as the 13-week US.

We also provide a downloadable excel template. Value-at-risk measures apply time series analysis to historical data 0 r 1 r 2 r. The audit risk assessment is not a guarantee you will not be audited.

If the return. R 2 08651. R-squared is a statistical measure that represents the percentage of a fund or securitys movements that can be explained by movements in a benchmark index.

Estimate the value at risk VaR for the portfolio by subtracting the initial investment from the calculation in step 4 1 Calculate periodic returns of the stocks in the portfolio. The number of flood events per year in DFO and Em-Dat is positively and significantly correlated over time Pearson correlation r 0591 P 001 consistent with previous results for 1985. The fair value can provide a glimpse of overall market sentiment.

Pensions also known as Defined Benefit plans. DCF Formula CF t 1 r t. Here we discuss how to calculate Risk Free Rate along with practical examples.

However the T-bill is generally accepted as the best representative of a risk-free security because its return. Ensure you request for assistant if you cant find the section. In order to calculate the Value at Risk for options and futures we require a series of returns which in turn requires time-series price data.

Abbreviation for augmented reality. This post will help you calculate the value of a pension. Using the menarche data.

For more information about the inputs and calculations used in this app see Terms and Concepts in the Resources tab below. The odds ratio for your coefficient is the increase in odds above this value of the intercept when you add one whole x value ie. Example of Net Present Value.

Notice that GBPUSD provided a small amount of risk reduction but hardly very much. The futures price may be different from the fair value due to the short-term influences of supply and demand for the futures contract. Import pandas as pd.

See PR AUC Area under the PR Curve. If youve got a pension count yourself as one of the lucky ones. Enterprise Value EV.

After filling out the order form you fill in the sign up details. In simple terms risk is the possibility of something bad happening. Value at Risk VAR is a statistic that is used in risk management to predict the greatest possible losses over a specific time frame.

/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)

Introduction To Value At Risk Var Formula

Calculating Var And Cvar In Excel In Under 9 Minutes

/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)

Introduction To Value At Risk Var Formula

Coefficient Of Determination Formula Calculation With Excel Template

:max_bytes(150000):strip_icc()/Variance-CovarianceMethod5-5bde86ce7819405ca63f26aa275a4bd2.png)

Introduction To Value At Risk Var Formula

0 Response to "Calculate Value at Risk in R"

Post a Comment